Applications of Robotic Process Automation in Quantitative Risk Assessment in Financial Institutions

Keywords:

Credit Risk Models, Financial Institutions, Market Risk Models, Operational Risk Models, Robotic Process Automation (RPA), Quantitative Risk AssessmentAbstract

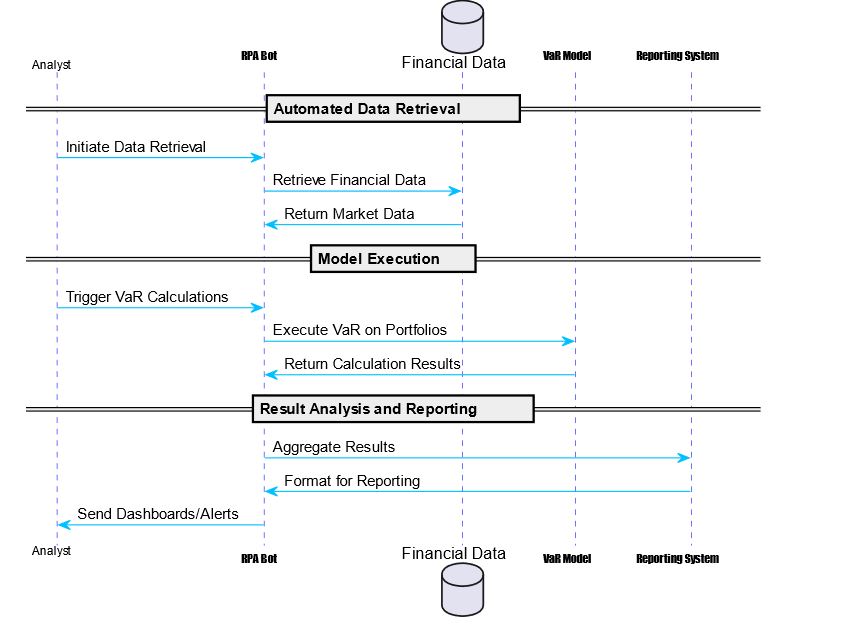

The integration of Robotic Process Automation (RPA) in quantitative risk assessment signifies a substantial advancement in financial risk management. Traditional approaches frequently grapple with the vast volume and complexity of financial data, which can lead to inefficiencies and potential inaccuracies in risk assessment modeling. The introduction of RPA can address these issues, offering a more effective and precise method for managing financial risks. This research aims to discuss the applications of Robotic Process Automation (RPA) within quantitative risk assessment models in financial institutions. The study is structured around four main types of risk models: Market Risk Models, Credit Risk Models, Integrated Risk Assessment Models, and Operational and Regulatory Compliance Models. Each model represents a unique dimension of risk assessment, ranging from market fluctuations to credit reliability, and from integrated risk management to compliance with regulatory standards. In Market Risk Models, the study examines Value at Risk (VaR) and Conditional Value at Risk (CVaR) / Expected Shortfall processes. These involve the interaction of an Analyst with an RPA Bot for the retrieval and processing of financial data, and the use of this data in executing VaR and CVaR calculations on portfolios. The emphasis is on how RPA aids in data aggregation, calculation, and reporting, enhancing efficiency and accuracy. Credit Risk Models are explored through the lens of an Analyst utilizing automated systems for scenario data management, risk analysis automation, and simulation setups. The focus is on the Analyst's role in initiating CVaR calculations and reviewing preliminary risk assessments, with a spotlight on the thousands of iterations executed by automated systems. Integrated Risk Assessment Models are explored for their use of RPA in stress testing, scenario analysis, asset-liability management, and liquidity risk analysis. The study highlights how RPA facilitates scenario generation, data processing, and integration in these complex models. Operational and Regulatory Compliance Models are investigated to understand the interaction between RPA Systems, Risk Assessment Systems, and Compliance Monitoring Systems. This research details how RPA aids in providing incident data for risk assessments and in using regulatory data for compliance monitoring. Across all models, the study shows the roles of RPA in streamlining processes, from data gathering and processing to analysis and reporting. The research recommend that RPA can not only enhances the efficiency and accuracy of risk assessments in financial institutions but also offers a transformative approach to managing financial risks in an increasingly complex and data-driven financial sector.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 International Journal of Business Intelligence and Big Data Analytics

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.