An Exploration of Artificial Intelligence Techniques for Optimizing Tax Compliance, Fraud Detection, and Revenue Collection in Modern Tax Administrations

Keywords:

AI in tax administration, fraud detection, machine learning, operational efficiency, risk profiling, taxpayer supportAbstract

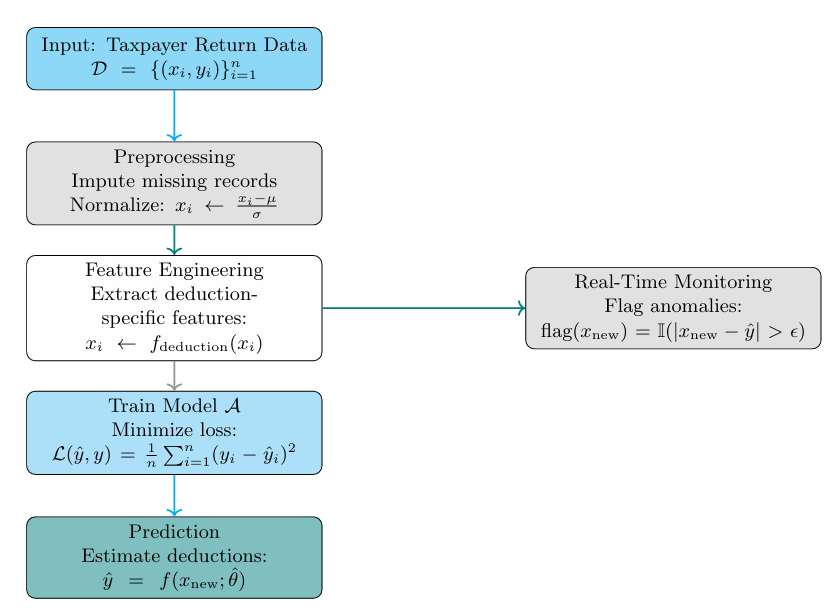

The U.S. tax system imposes substantial economic and administrative burdens on taxpayers, requiring significant investments of time, energy, and financial resources to comprehend and comply with its intricate and often opaque regulations. Artificial Intelligence and Machine Learning are at the forefront of transformative forces spanning a great number of industries, and the tax and revenue sector is not an exception. The ability of these technologies to analyze large and complex datasets, uncover patterns, and generate actionable insights presents significant opportunities for improving tax administration efficiency. AI can streamline taxpayer classification, verify the consistency of tax return data, detect potential fraud, and improve debt collection strategies y automating labor-intensive processes , all while reducing operational costs and empowering tax officials to make more informed decisions. This paper outlines how AI-driven solutions can be systematically integrated into tax administration workflows—covering several activities such as identifying taxpayers’ economic activities, reviewing income tax deductions, deploying virtual agents for taxpayer support, and prioritizing audit or investigation targets. Various ML-based approaches can also address document classification during audits, estimate the probability of successful supervision activities, and project collection costs for arrears. We also explored how graph analytics can help discover intricate relationships among taxpayers and build more accurate risk profiles. This paper elucidates the ways in which AI-enhanced tax administration can significantly help compliance, reduce fraudulent activities, and promote an equitable and transparent fiscal environment by emphasizing the applications, considerations for implementation, and the consequent organizational and fiscal advantages.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 International Journal of Business Intelligence and Big Data Analytics

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.